By Andrew Marsh, FIMI, Hon member of IAEA

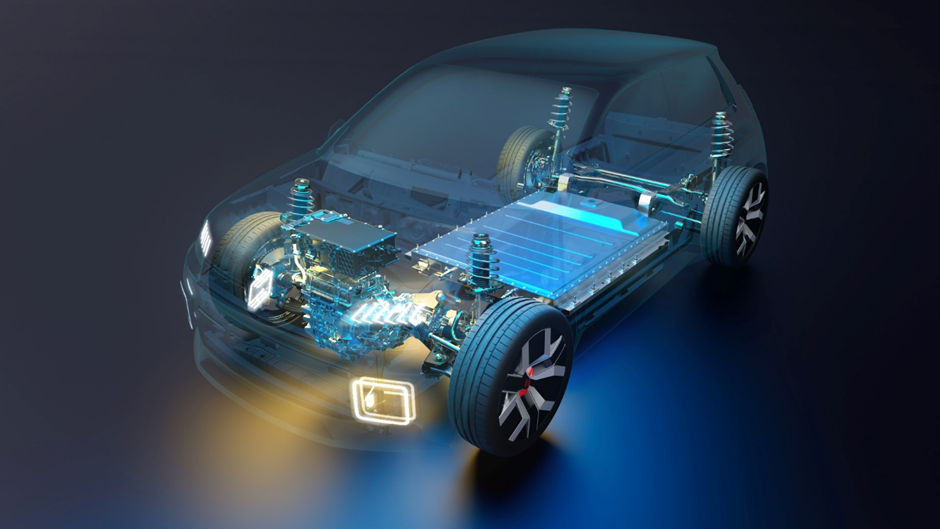

In one part of the automotive market pricing remains very sensitive – namely battery electric vehicles (‘BEV’). Compared with other powertrains, these remain at a price disadvantage primarily due to prevailing Li-Ion battery technology, the single most expensive sub-assembly, compared to internal combustion engine (‘ICE’) or electrified ICE powertrains. While older Li-Ion battery technologies have fallen in cost, newer, more energy dense systems command higher prices – countering price reductions.

The BEV market is very sensitive to rebates or tax incentives, which has in turn played havoc with residual values. It could be said many BEVs, even with known defects, have been undervalued. Another reboot was required….

Which leads to the present ‘cunning plan’ from Baldrick: Aim to sell BEVs at around £30000 or less. Within the EU27 the magic number is under €20000. This should boost volume and increase rate of adaption, disregarding where the electricity comes from….

Stark reality

2025 has been a very interesting year.

The European manufacturers knew they could price match by stripping the lowest cost product back, while the EU27 Commission imposed additional 10 per cent tariffs on all China built BEVs – with some moderation for companies that ‘co-operated’.

We learnt that China vehicle manufacturers can take an additional 10 per cent import tariff and remain profitable. European manufacturers quickly saw this confirmed their suspicions, and could apply to all vehicle market segments.

BEV structural quirks

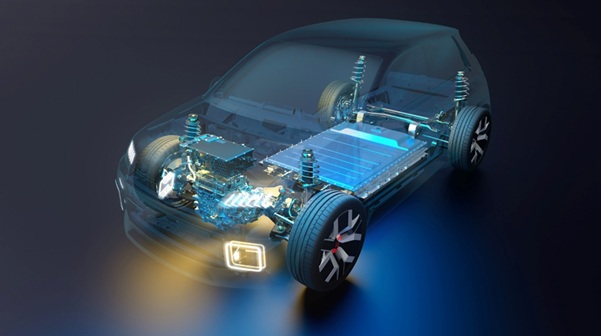

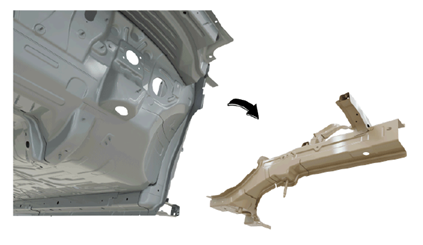

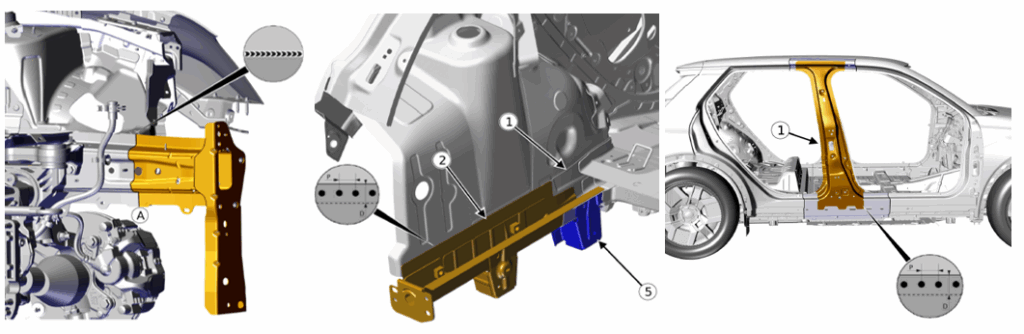

BEVs do not need front chassis legs of the type typically used when an internal combustion engine is present. Even if the BEV has a front drive motor, the impact intrusion is far easier to manage. The following images are from a Kia EV3, and are somewhat typical of BEV front end repair… the chassis leg end plate can be repaired, but not other sections. So, there are two large assemblies:

- Inner chassis leg with splayed brace for the lower front bulkhead

- Outer front chassis leg with strut tower and upper longitudinal.

By Andrew Marsh, FIMI, Hon member of IAEA

In one part of the automotive market pricing remains very sensitive – namely battery electric vehicles (‘BEV’). Compared with other powertrains, these remain at a price disadvantage primarily due to prevailing Li-Ion battery technology, the single most expensive sub-assembly, compared to internal combustion engine (‘ICE’) or electrified ICE powertrains. While older Li-Ion battery technologies have fallen in cost, newer, more energy dense systems command higher prices – countering price reductions.

The BEV market is very sensitive to rebates or tax incentives, which has in turn played havoc with residual values. It could be said many BEVs, even with known defects, have been undervalued. Another reboot was required….

Which leads to the present ‘cunning plan’ from Baldrick: Aim to sell BEVs at around £30000 or less. Within the EU27 the magic number is under €20000. This should boost volume and increase rate of adaption, disregarding where the electricity comes from….

Stark reality

2025 has been a very interesting year.

The European manufacturers knew they could price match by stripping the lowest cost product back, while the EU27 Commission imposed additional 10 per cent tariffs on all China built BEVs – with some moderation for companies that ‘co-operated’.

We learnt that China vehicle manufacturers can take an additional 10 per cent import tariff and remain profitable. European manufacturers quickly saw this confirmed their suspicions, and could apply to all vehicle market segments.

BEV structural quirks

BEVs do not need front chassis legs of the type typically used when an internal combustion engine is present. Even if the BEV has a front drive motor, the impact intrusion is far easier to manage. The following images are from a Kia EV3, and are somewhat typical of BEV front end repair… the chassis leg end plate can be repaired, but not other sections. So, there are two large assemblies:

- Inner chassis leg with splayed brace for the lower front bulkhead

- Outer front chassis leg with strut tower and upper longitudinal.

Similarly at the rear, due to the frequent possibility of an electric motor with integrated power controller driving the rear wheels, the rear chassis leg section may not be offered.

Fewer major sub-assemblies during the vehicle build, but more work to repair in the event of damage.

The fight back

Ampere, part of Renault Group, launched the AmpR Small platform which is now used for Renault 5 and Renault 4 E-Tech Electric. Dedicated to BEV, it sought to have a clean sheet approach to whole life cycle costing.

As we can see the front and rear chassis leg sections are possible, as well as major repairs such as the B pillar.

What are the implications of a budget BEV?

A smaller vehicle does not mean a smaller budget to create it given organisations such as Euro NCAP demand a level of functionality which gives no ‘escape’. Making a decent profit is harder, since consumers have been brought up with the idea smaller means less expensive.

To improve profitability requires using fewer parts per vehicle, and in turn carefully managing the tooling investment to dive additional functionality to those same parts. This is very hard to do, and many manufacturers all over the world have tried to do this for a very long time.

The next generation Twingo will use an of this evolution platform with fewer parts…. So what could happen to repairability? In other words, the build and assembly costs are taken care of, the vehicle is sold to customers who just might find it’s rather complicated to repair due to the simplified build process.

Assuming the build and repair equation can be balanced, what is to stop other manufacturers simply copying it? Very little.

Yet the assembly cost is where the biggest change could happen, via the fewer parts increased functionality and assembly line automation – much as framing bodyshells was revolutionised years ago. The problem is as fast as the European manufacturers innovate, the well-known competition seem to get hold of the same ideas and make them via a slightly lower cost base, maintaining their commercial advantage.

Could this be a downwards spiral?

China strengths and weaknesses

The China automotive sector is an overnight success which was 40 years in the making. Through multiple collaborations the sector has learnt a lot about fit / finish, while both central as well a region government are prepared to subsidise exports too.

The weakness is around launching too many brands with too many overlapping products leading to mass confusion, and in the short term, negative effects on residuals. A further weakness demonstrated multiple times in the Middle East as well as across Africa, is product support. Compare the approach of SAIC (MG Motor / Maxus) to other brands – they have much to learn from SAIC as well as Geely (Polestar / Volvo Car).

The major issue is to prevent the single use vehicle.

It matters little if this is driven by Europe or China, it is in nobody’s interests to end up in this situation. Vehicle valuation –BEV depreciation is not fully understood yet – needs recalibration to ensure there is enough retained value for repair. ADAS / SAE autonomy Level 3 and above will not eliminate collision repair for some time to come.

The process to single use vehicles is speeding up.

Massive changes vehicle manufacturers have undertaken may not be reflected in the world of vehicle valuations. Unchecked, this could cause immense damage to insurers, assessors and the collision repair business.