The UK vehicle market and especially the policies which are shaping it will have a profound effect. Nobody quite knows how this will play out, but there are at least three scenarios….

Scenario 1 – Mass adoption of pure electric vehicles

The ‘independent’ Environment and Climate Change Committee formerly chaired by Lord Deben (former MP John Selwyn Gummer) produced a report in October 2022 called “In our hands: behaviour change for climate and environmental goals”. The dream is to get everyone into pure electric vehicles (‘BEV’), and to use a series of taxation and other measures to ‘encourage’ adoption.

Several issues emerge:

- The UK parc rate of change runs at between 1.5 and 2.5 million units per year, so if every single new vehicle sold from now on is a BEV it would take up to 15 years to complete the changeover.

- The new vehicle sales with internal combustion engine (‘ICE’) ‘ban’ after 2030 in the UK or, 2035 in the EU and UK when equipped with MHEV, HEV or PHEV powertrains.

- BEV models typically cost 40 per cent more than models powered by MHEV, HEV or PHEV powertrains. There are also significant global battery supply constraints.

- The main battle ground of the transition to BEV is charging, especially during trips. The only public charger network with proven reliability, availability and near-national coverage is from Tesla.

- This all ignores the main issue – the UK does not have enough electricity generation capacity to meet existing demands, without an additional 2.5 million plus BEVs per year for the next 15 years.

Significantly improved batteries, charging systems and additional electricity generation will not be in place much before 2035, assuming politicians make any decisions now, which is much more difficult than adding a green strip to the number plate.

Scenario 2 – U-turn

There is a huge amount of finance tied up in the vehicle market. Most of the vehicles financed right now are not BEVs – so who will take the hit for residual value degradation caused by legislation deadlines?

Could the public simply disobey the Government? The taxes would fly around, but the gross inefficiency of Big State would mean fines just pile up, unpaid. The potential huge financial loss due to residual value falls might force a political U-turn, and revert to ‘user choice’ rather than law.

Scenario 3 – delay

It is likely the events which saw oil traded in Yuan (backed by gold) instead of the USA dollar along in 2022 with alliance of India, Iran, much of Africa, much of South America, Russia and China will deepen the financial crisis facing the USA, Europe and many other ‘developed’ nations. Such is the pace of events the ‘developed’ economies are now starting to behave like ‘emerging’ economies.

Imagine the unimaginable. The pound becomes in effect worthless, and our major trading partners including the EU27 are in the very same boat. What then? The UK economy could keep moving with the most effective energy sources – petrol and diesel – rather than forcing people to only buy BEVs.

Coming in from the East

There will be a big change in how customers interact with the aftermarket, driven by:

- Recession that has been underway in real terms since 2023

- BEV sales are small scale, rapidly growing, but missing the target volumes set by HM Government.

- The possibility ICE powered vehicles will routinely reach 15 years old or more, as customers extend their life.

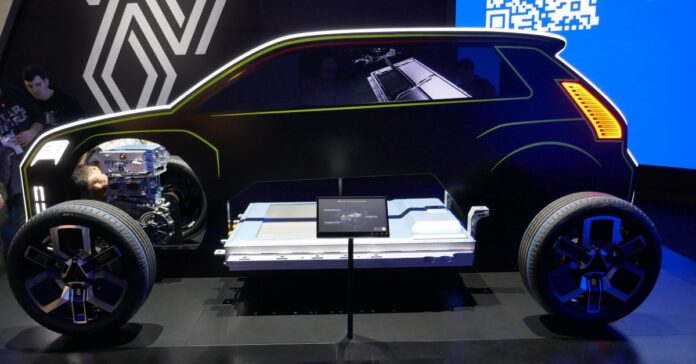

China has strategically seen automobiles as a key export, with a move from building vehicles for ‘foreign’ manufacturers to making their own. The domestic manufacturers have had massive state support to create the biggest BEV market in the world, and of course, the biggest vehicle market in the world too. China is hungry for all types of vehicles and powertrains.

Starting in 2023 the big push to get BEVs into Europe will begin, and the first wave of transporter ships were loaded up at the end of 2022, just as some China provinces came out of ‘lock down’. Apart from established players such as the SAIC’s ‘MG Motor’ and ‘Maxus’, most of these new-comers will land with initially almost no product support, a significant purchase price advantage and apparently generous warranty.

In the real world….

BEVs typically have fewer routine wear parts, but the immense torque from stand-still will result in a steady stream of wheel bearing / driveshaft repairs, to say nothing of suspension bushes / cracked links – after 4 or 5 years. It’s as if every Vauxhall Corsa F was really a BMW M4 all along….

The mix of repairs will gain some new aspects:

- Huge emphasis on vehicle software, covering everything from the traction battery control module to on-board heat pump.

- The addition of CO2 refrigerants.

- Repair of otherwise difficult to recycle traction batteries, including cells / packs inside the module.

- The challenges in keeping otherwise conventional vehicles going as traditional OEM and high-quality Tier 1 parts supplies dry up.

BEVs have captured 19.6 per cent of the new car market in the UK during 2024, with 381,970 cars sold. That’s before counting hybrids or plug-in hybrids, which added 428,576 cars sold in 20214 (22 per cent of the market). By the way, total sales of LCV up to 4.25 tonnes GVW in 2024 amounted to 22,155 units, 6.3 per cent of the market… diesel is still ‘king’.

In the case of BEVs throwing away huge – and expensive – modules will affect residuals. So, the collision repairer needs to think about adding new skills, and new services such as HV battery rebuilds. The market exists right now, and is steadily growing.

The key message is not to assume very much at all, but tread carefully.

Rest assured; Lord Deben will need no thanks.